Last week we finally saw quite positive results for the major US stock indexes. Those most beaten down rose the highest: Nasdaq 100 by 7 percent, S&P 500 by 6.5 percent and the Dow Jones 30 by 6.2 percent respectively. Even the long dated Treasuries took a breather and their value rose as the 30 year bond yield dropped .8 percent.

Last week we finally saw quite positive results for the major US stock indexes. Those most beaten down rose the highest: Nasdaq 100 by 7 percent, S&P 500 by 6.5 percent and the Dow Jones 30 by 6.2 percent respectively. Even the long dated Treasuries took a breather and their value rose as the 30 year bond yield dropped .8 percent.

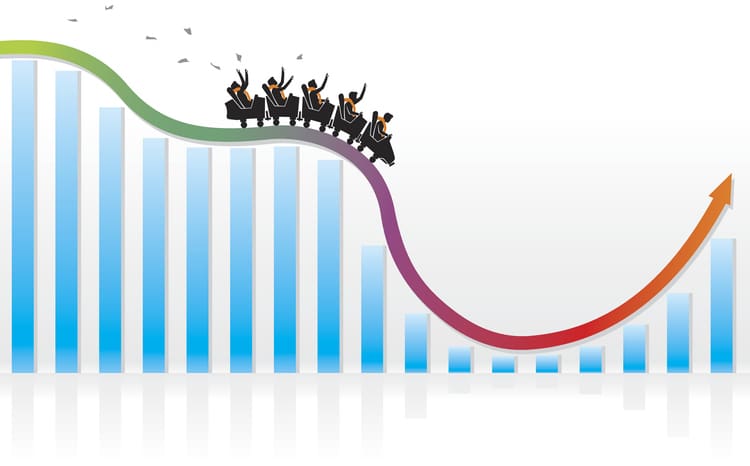

This counter movement had been long overdue since stocks’ slide began from the intermediate high point of March 29. I add the reminder that a bear market still resembles a saw blade, but the saw is pointed downward. Highs and lows descend rather than ascend as in a bull market.

As I write today on Tuesday morning, May 31, the bears are hard at work to pull stocks and bonds down in price again. During a classic bear market, the upward counter trends can last for several weeks and this one may also last longer. The March rally lifted the S&P 500 by 11 percent in three weeks, but it ended Friday still more than 10 percent lower.

There is no great evidence of strength in the latest rally since trading volumes reduced to a low point as the week progressed (for the S&P). Friday was the highest gain, but the lowest trading volume, not a positive sign for Mr. Market. The current index prices also are lower than their 50, 100, and 200 day moving averages.

As the prices of this rally approaches the lowest of these, the 50 day price average, resistance to the upturn continuing increases and usually, prices fall further. A longer lasting price rally will probably not occur until you see a stronger capitulation.

A capitulation is the time when many investors are so demoralized that they themselves sell everything or order their broker representative to sell everything they hold. The absolute bottom of this current bear market will occur when everyone who is sorely tempted to sell has finally sold.

Then the professionals will again begin to buy in earnest and a new bull market begins. Technical analysis, based upon charts, graphs, and numbers, often only works because human nature never changes. The patterns persist no matter the various external causes, whether war, political change, or a future recession.

But one alternative is to find bullish positions that are strong enough to buck the downtrend. For example, there are 14 stocks in the Nasdaq 100 that are ahead by at least 2 percent this morning. In the S&P 500, 152 stocks are positive for the year to date. Of course, those ETF’s that are inverse to the stock indexes are also naturally higher.

The best news is that our lives all consist of far more than our money, even as important as it is to our sustenance. Whether this bear continues to roar for weeks, months or even a couple of years, it too shall pass. Look for the outliers that are rising in the meantime, as we are.