Investment Management

What is Active Management?

The term active management means that an investor, a professional money manager, or a team of professionals is tracking the performance of an investment portfolio and making buy, hold, and sell decisions about the assets in it. The goal of any investment manager is to outperform a designated benchmark while simultaneously accomplishing one or more additional goals such as managing risk, limiting tax consequences, or adhering to environmental, social, and governance (ESG) standards for investing.

– Investopedia, June 11, 2022 https://www.investopedia.com/terms/a/activemanagement.asp

During times of market volatility, you want to work with an investment manager who will do more than just hold your hand and comfort you as your account falls in value. That’s why at Stewardship Capital we actively adjust your portfolio based on current market conditions, rather than using the set it and forget it approach most advisors use.

“You wouldn’t drive at one consistent speed on all roads, under all weather conditions. So why do you use that strategy with your investing?”

You deserve to work with an advisor that is willing to take prompt action in your accounts during market downturns, to protect your hard- earned money from losses. Contact us today to set up an obligation free Get Acquainted meeting. We’d love to see how we could be of service to you. Click button below to schedule a ‘Get Acquainted Meeting’ with one of our advisors:

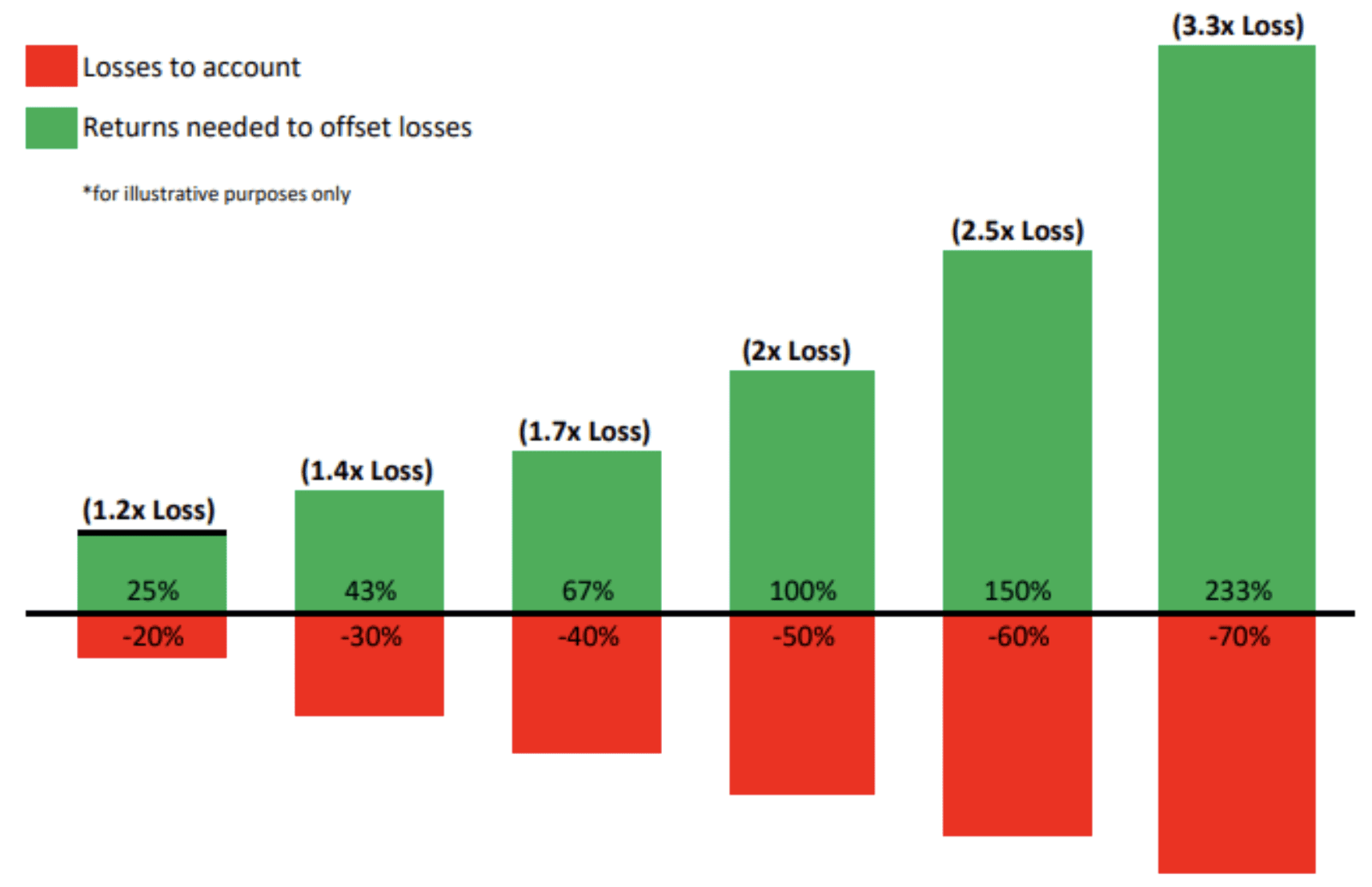

The more you lose, the more gains it takes to recover

Let’s take for example a person that invested $100,000. At the beginning of last year. In this hypothetical example, let’s say they lost 20% and began 2023 with a balance of $80,000. You might assume that if their account gains 20% this year they will return to their starting balance of $100,000. That however would not be the case. A 20% gain on $80,000 only gets their balance to $96,000. They would actually need a 25% gain on the remaining $80,000 just to get back to their original balance of $100,000.

Even, worse, lets Imagine the losses were significantly more and their losses were 50%, reducing their balance to $50,000. In that scenario, the person would need gains of double what they lost just to break even. At a 70% loss the gains needed just to get back to where they started would be 233% or roughly 3.3 times what they lost.

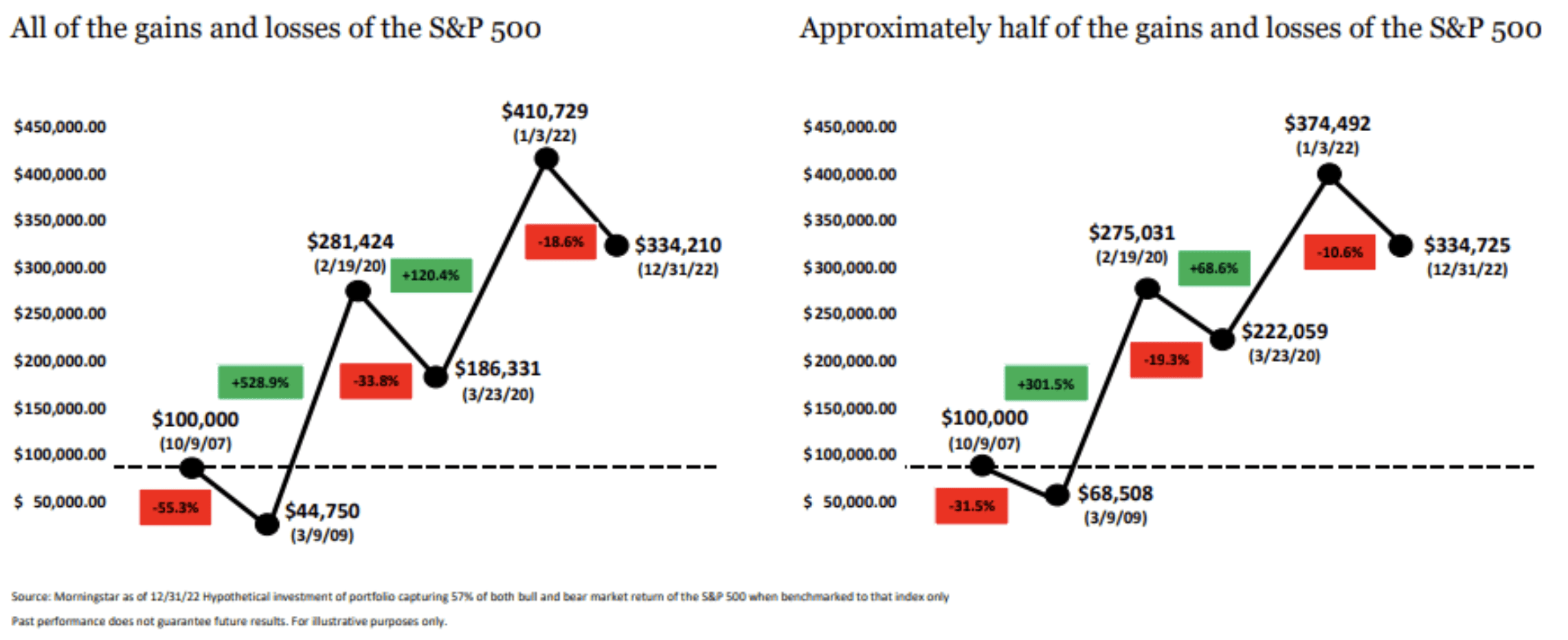

Make more by losing less

The stock market can be a roller-coaster of highs and lows. You may believe you have no choice but to take the ride. We believe there is another way. The example below shows the approximate return of two portfolios. One receiving all ups and downs of the S&P 500, the other receiving half of both the ups and the downs. As you can see, by avoiding much of the losses you can still get all of the gains. Now that you understand our some of our strategy, be sure to contact us for a face to face or virtual meeting. We’d love to tell you more! Click the button below to Schedule a meeting with one of our Advisors:

Professional Approach

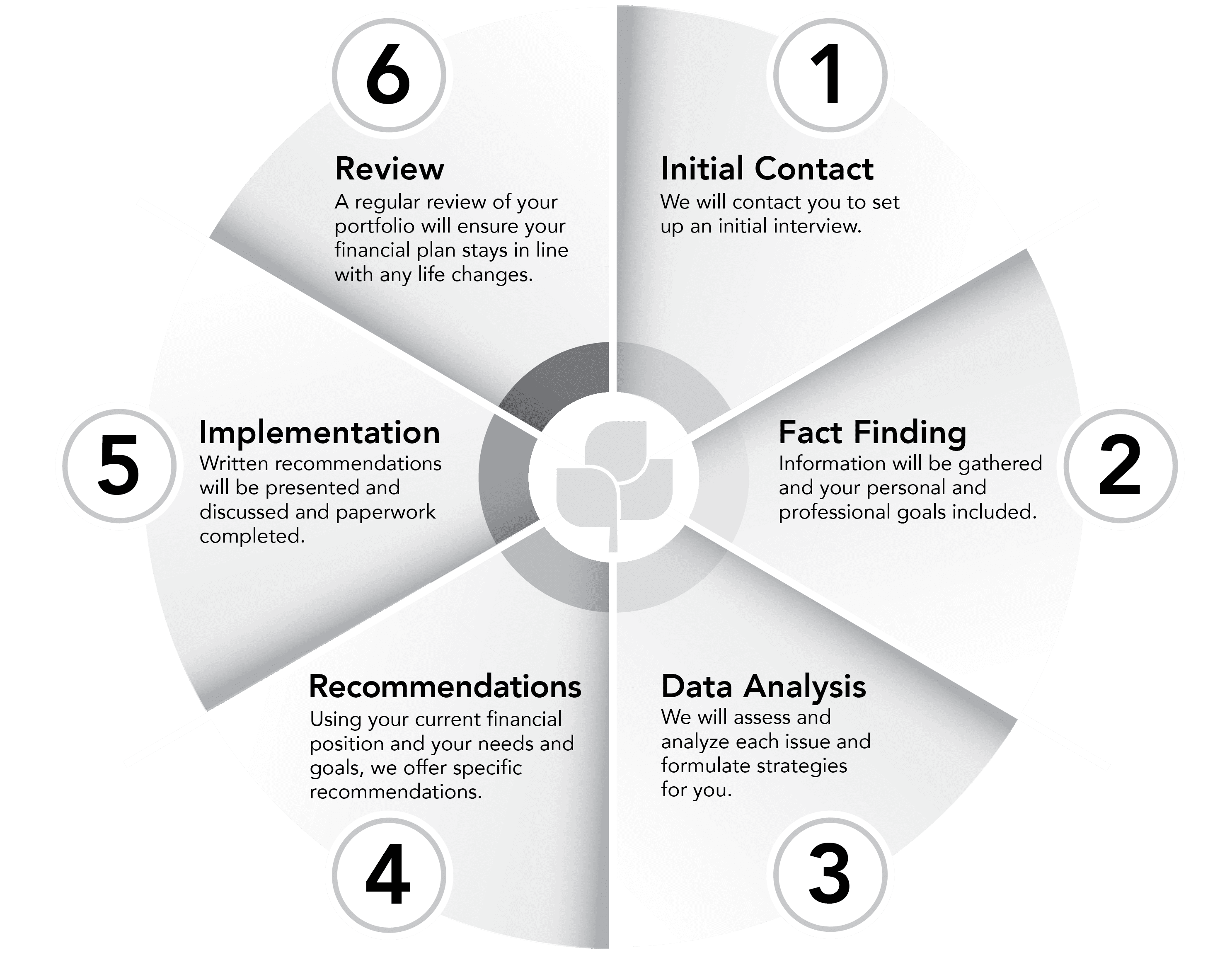

As one of our valued clients, we commit to working with you to determine areas for development within your financial situation and to implement several practical initiatives to drive your finances successfully into the future.

This process acts as a symbol of commitment for all parties – that your Financial Plan will be proactively pursued and implemented as required.

The process that we apply when dealing with clients for the first time can be broken down into six basic steps:

Financial Planning

Financial planning is the cornerstone for long-term financial stability and growth. At Stewardship Capital, we simplify the planning process to help you put your resources to work and build a secure future. We utilize the industry leading financial planning software to help you answer the most important questions you face financially.

Insurance

Insurance is an essential tool when preparing for life’s unknowns. With the right policies, you will minimize the risk of uncertainty and have confidence, that you are prepared for situations beyond your control. As independently licensed insurance brokers, let our experienced staff guide you in finding the best and most cost-effective protection for you and your family.