This past Friday, the US Bureau of Labor Statistics released its job numbers for September. To the surprise of many experts, the labor market added 254,000 jobs. This was substantially higher than the projected 150,000. Revisions to July and August numbers resulted in an additional 72,000 jobs for those months as well.

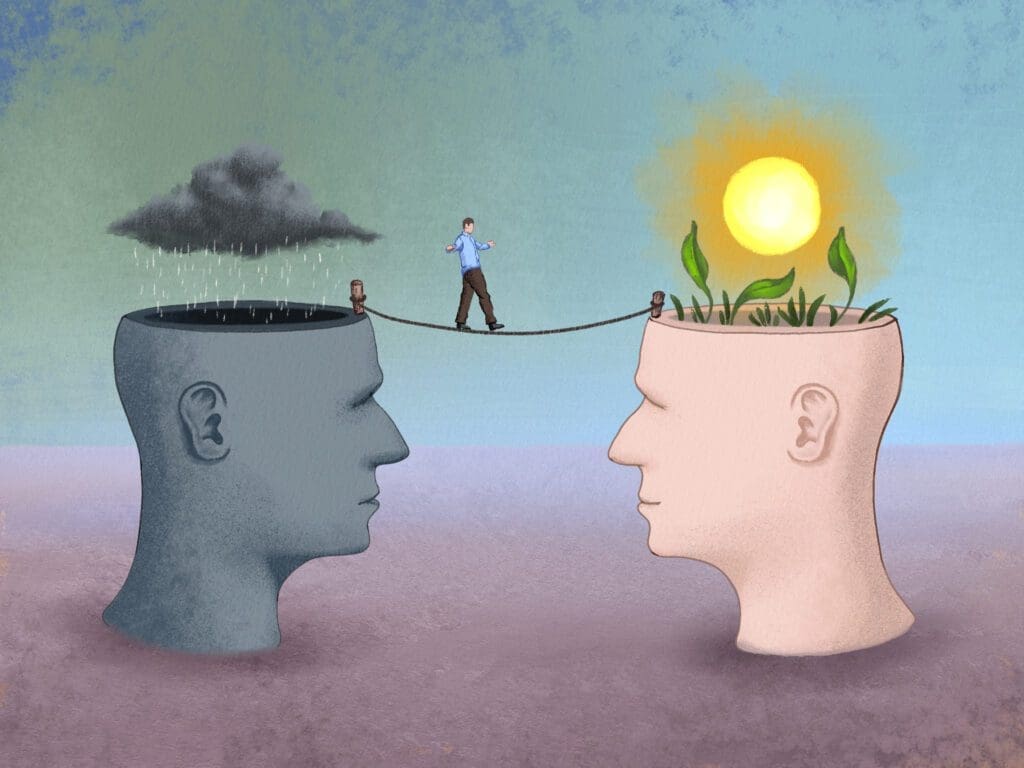

These numbers are in stark contrast to the feeling of pessimism many Americans have expressed about the economy recently. According to Dana M. Peterson, Chief Economist at The Conference Board, September saw the sharpest drop in consumer confidence since August of 2021, and was near a two-year low in September as well.

So, what exactly is happening? Is the economy strong as market and jobs data might indicate? Or are we nearing recession as consumer sentiment might suggest?

I would argue this disconnect between what is perceived and what is actually happening in our economy is likely more due to our current social and geopolitical climate than anything else. Psychologist Roy Baumeister points out that as humans our emotional bias always leans toward pessimism. In times of change or fear our defense mechanism is usually to expect the worse, even if logically that is not the most likely outcome. We have certainly seen our fair share of societal change and volatility over the past few years, which I think is playing a role in our assessment of what lies ahead.

It’s also not helping that this is an election year. During this part of the election cycle, we are being inundated with arguments for why things will collapse if the other person is elected. How can anyone be optimistic when all we are being fed is doom and gloom?

Am I saying that since the economic numbers appear solid, there’s no reason to be fearful of a potential recession? Absolutely not. In fact, perception often is reality when it comes to the economy. According to Journal of Banking and Finance there is comprehensive empirical evidence that sentiment variables hold vast predictive power of future recessions. The reason is consumer behavior is the biggest determiner of economic contraction. If people fear they may lose their job or face future economic difficulties, they will naturally reduce spending. As people buy less, businesses lay off individuals which triggers people to buy even less, which in turn leads to more layoffs and the cycle continues.

I’m sure many of you are now hoping I will now look into my crystal ball and declare whether or not a recession is eminent. Sadly, if that is your hope you are going to be disappointed. The truth is its generally a fool’s errand to try and predict the market. Especially in our present circumstances. Right now, I believe the stock market has baked into its valuations a half point interest rate cut in November. These new job numbers may cause the fed to reduce or even cancel that expected cut. If that happens markets would likely fall in the short-term.

Longer term, it’s very possible continued positive economic indicators could calm peoples fears and motivate them to spend more money resulting in a continued bull market. Perhaps equally possible is the likelihood that Americans remain pessimistic and the recession they believe is just around the corner becomes a self-fulfilling prophecy.

That’s why at Stewardship Capital we don’t try to time the market. Instead, we believe in taking action when market trends become apparent. We are still generally conservative at the present time, opting on the side of caution. However, if the economic climate changes, which it certainly could, we might take our foot off the brakes. Until then, discretion remains the better part of valor… at least for us.

(Past performance is no guarantee of future results. The advice is general in nature and not intended for specific situations)